finanzmarktwelt – Ihr Auge im Zentrum der Finanzen

Dax nimmt 18.000 Punkte ins Visier – Berichtssaison im Blick

SAP-Quartalszahlen: Erwartungen gerade so erfüllt, Ausblick bestätigt

Nasdaq: Kippen Big Tech-Aktien? Großbank warnt! Marktgeflüster (Video)

Alphabet, Apple, Amazon, Meta, Microsoft und Nvidia UBS stuft die großen US-Tech-Aktien ab – schwächeres Gewinnwachstum

Chartanalyse Dow & DAX vs. S&P & Nasdaq

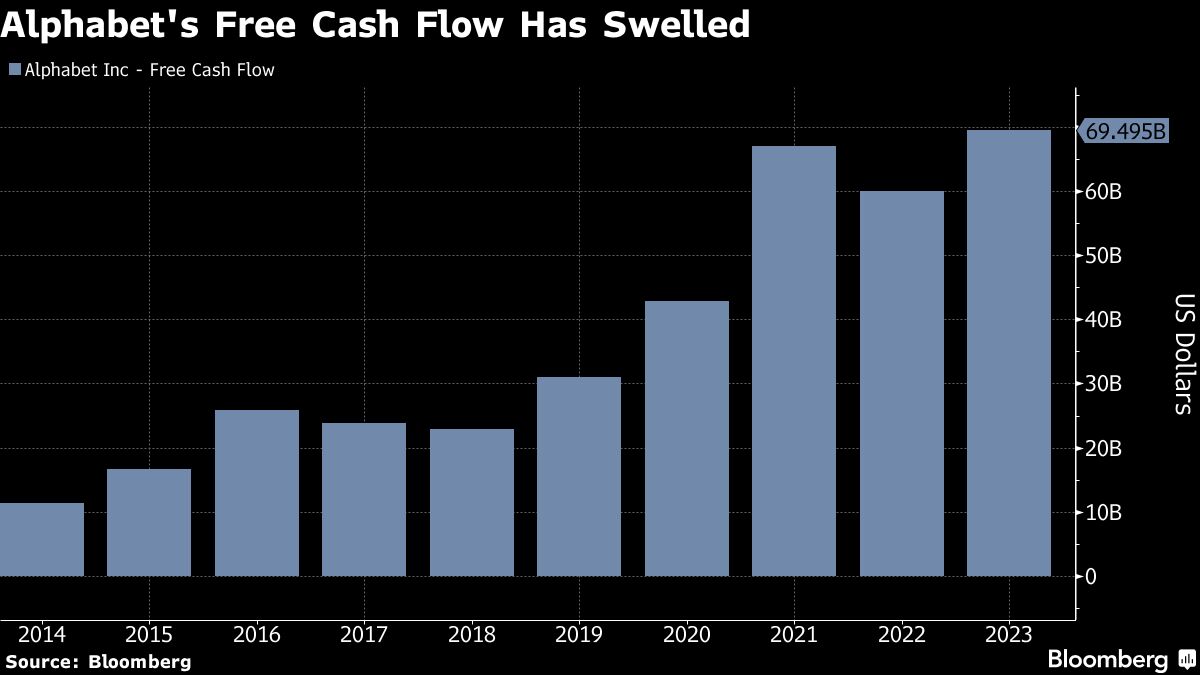

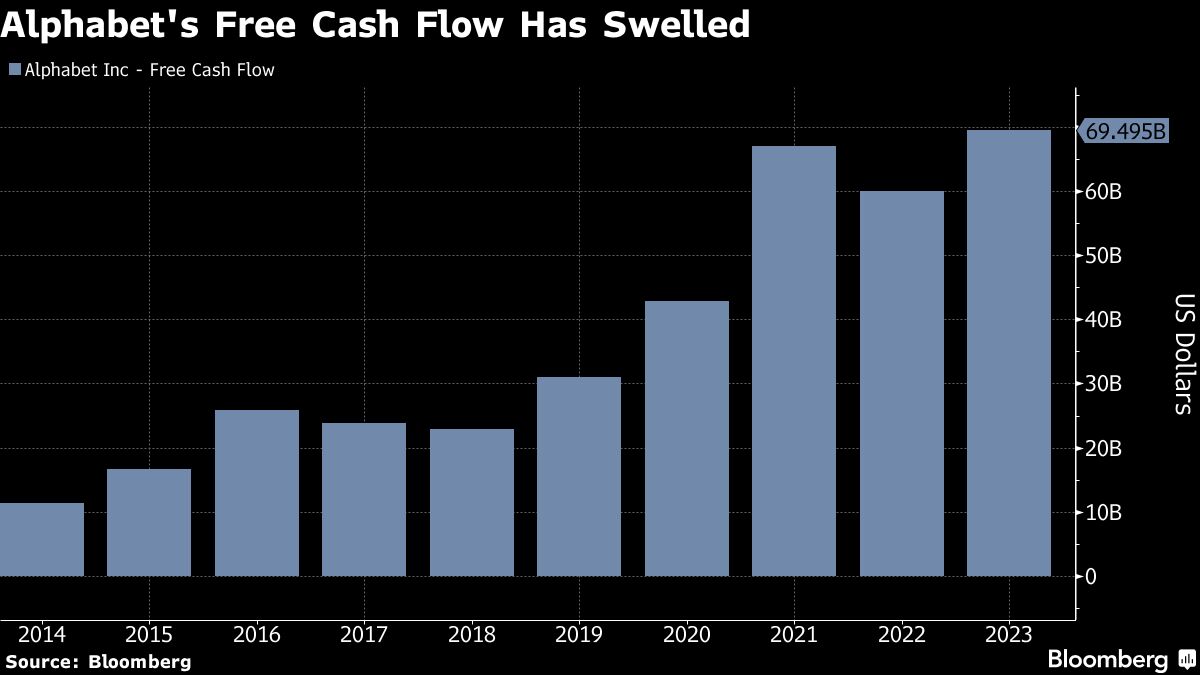

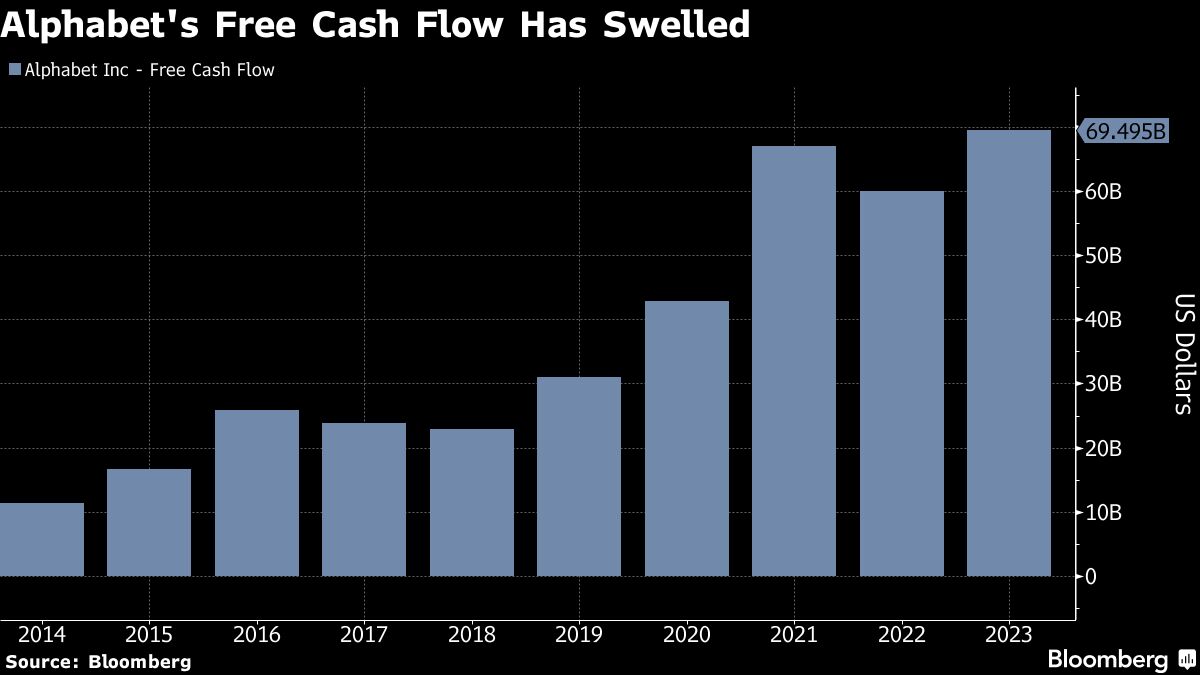

Alphabet-Quartalszahlen Donnerstag: Hoffnungen auf Dividende!

Spannungen zwischen USA und China TikTok-Verbot: USA gegen „Achse des Bösen“ China, Iran und Russland

Aussagen von Francois Villeroy de Galhau Zinsen senken im Juni – Öl-Unsicherheit kein Hindernis laut EZB-Entscheider

Meist gelesen 7 Tage

EZB senkt die Zinsen im Juni, Fed nicht – Abweichung birgt Risiken

Ölpreis und Fed-Politik bergen Risiken EZB senkt die Zinsen im Juni, aber was kommt danach?

Unsere Zinsen - euer Problem.. Powell-Aussagen zu Zinsen sind Problem für die „Rest-Welt“

Bitcoin-Halving ist abgeschlossen – die aktuelle Lage

Ausblick bis Jahresende Zinsen senken – Großbanken sehen nur noch 3 EZB-Schritte

Interessante Gründe für bisherige Rally Goldpreis-Rally geht die Puste aus? Aktuelle Expertenaussagen

Die ungebrochene Nachfrage Chinas Gold: China steht im Mittelpunkt der rekordverdächtigen Rally

Super Micro Computer: Aktie crasht um 17 % – der Grund

Nasdaq: KI-Blase platzt weiter – und Verfalls-Erscheinungen! Marktgeflüster (Video)

aktien

SAP-Quartalszahlen: Erwartungen gerade so erfüllt, Ausblick bestätigt

Die SAP-Quartalszahlen zeigen: Die Erwartungen wurden ziemlich genau erfüllt, der Ausblick für 2024 wird bestätigt.

Alphabet-Quartalszahlen Donnerstag: Hoffnungen auf Dividende!

Die Google-Mutter Alphabet meldet Donnerstag Zahlen. Erstmals könnte man (wie zuletzt Meta) die Zahlung einer Dividende verkünden.

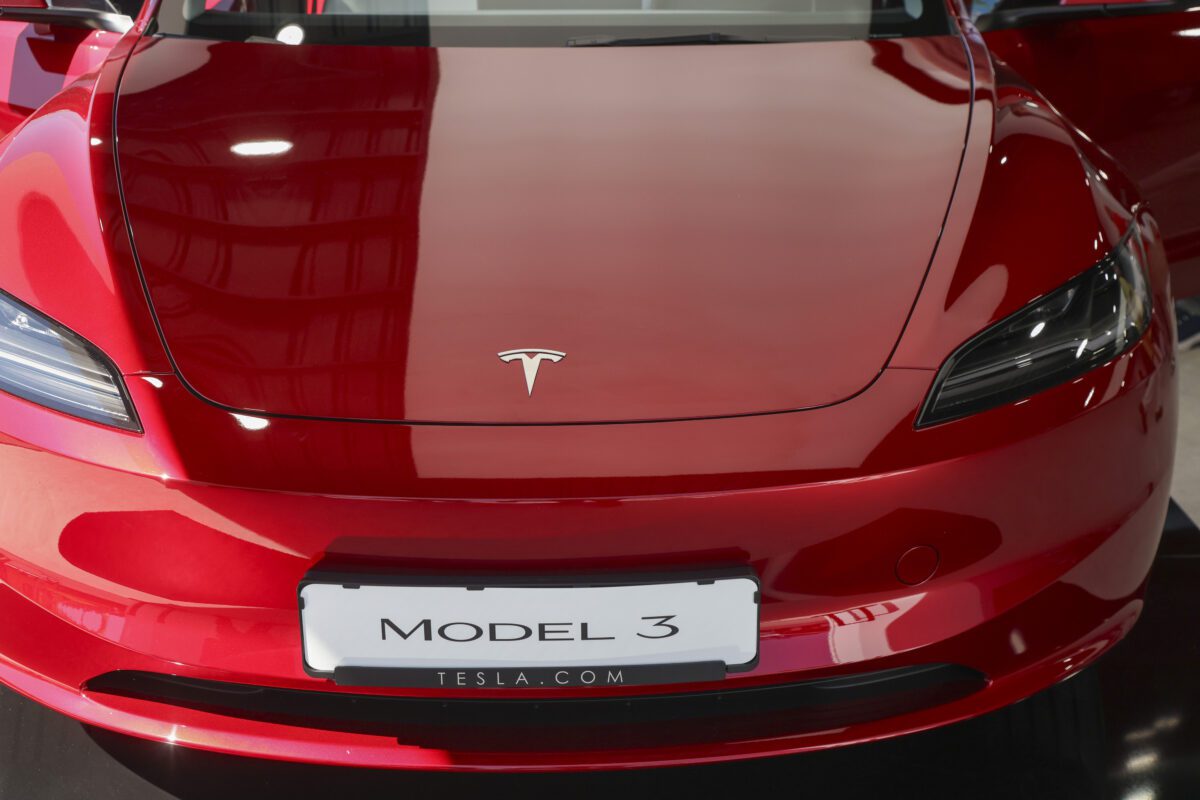

Tesla vor Quartalszahlen: Analyst blickt auf „Großen Reality-Check“

Tesla meldet morgen seine Quartalszahlen. Ein Analyst blickt mit seiner Analyse auf die aktuell düstere Lage des Autobauers.

Allgemein

Aussagen von Francois Villeroy de Galhau Zinsen senken im Juni – Öl-Unsicherheit kein Hindernis laut EZB-Entscheider

Laut einem wichtigen EZB-Ratsmitglied wird die Unsicherheit beim Ölpreis die Senkung der Zinsen im Juni nicht behindern.

"Seit Jahren besorgniserregender Abwärtstrend" Industrieproduktion soll in 2024 weiter sinken – BDI-Aussagen

Die Industrieproduktion ist seit sechs Jahren schon um 13 % rückläufig, und der Industrieverband BDI sieht für 2024 ein Minus…

Tesla senkt die Preise in China Tesla hat Probleme über Probleme – Neue Runde im Preiskampf

Der angeschlagene Elektroautobauer Tesla senkt erneut die Preise in China und befeuert damit den dort tobenden Preiskampf. Auch in den…

Rohstoffe

Ölpreis fällt weiter – gefährliche Ignoranz vor Israel-Angriff?

Der Ölpreis rutscht weiter ab. Der Ölmarkt scheint die Gefahr des anstehenden Israel-Angriffs zu irgnorieren oder als harmlos anzusehen.

Aktuell: Öl-Lagerbestände +2,7 Mio Barrels (jetzt 460,0 Mio)

Die wöchentlich vermeldeten Öl-Lagerbestände in den USA (Rohöl) wurden soeben mit 460,0 Millionen Barrels veröffentlicht. Dies ist im Vergleich zur…

Israel vor Angriff gegen den Iran Ölpreis vor massivem Anstieg? Rekordumsatz bei Call-Optionen

Der Handel mit Call-Optionen auf den Ölpreis erreicht ein Rekordhoch, da der israelische Angriff auf den Iran bald starten könnte.

Indizes

Dax nimmt 18.000 Punkte ins Visier – Berichtssaison im Blick

Zum Wochenauftakt hat der Dax etwas Boden gutgemacht, nachdem er vorige Woche ein Minus von 1,1 Prozent eingefahren hat. Vor…

Markus Koch LIVE – Ist der Boden am Aktienmarkt gefunden?

Markus Koch meldet sich LIVE. Nach dem Absturz am Freitag ist die Frage, ob der Markt seinen Boden gefunden hat.

Zwischen Hoffen und Bangen Aktienmärkte an kritischem Punkt: Big Tech-Zahlen als Todesstoß?

An der Wall Street steigt die Spannung, denn in dieser Woche werden einige Big Tech-Werte wie Alphabet und Microsoft ihre…

Konjunkturdaten

Starke Inflation bei Dienstleistern wegen Löhnen Deutschland: Industrie in tiefer Rezession, Dienstleister stark

Die Industrie ist in Deutschland weiter im Sinfklug, die Dienstleister aber sind robust – das zeigt der Einkaufsmanagerindex für die…

Erzeugerpreise der Industrie jetzt neun Monate am Stück deflationär

Die Erzeugerpreise der deutschen Industrie sind jetzt neun Monate am Stück deflationär. Im März waren es im Jahresvergleich -2,9 %.

US-Renditen steigen Wirtschaft USA: Erstanträge ok, Philadelphia Fed Index stark – Preise höher

Neue Daten zur Lage der Wirtschaft in den USA: Die US-Erstanträge (jobless claims) auf Arbeitslosenhilfe (für die letzte Woche) –…

Aktien

Tesla-Quartalszahlen heute Abend – Vorschau auf die Daten

Heute Abend kurz nach 22 Uhr meldet Tesla seine Quartalszahlen. Hier bieten wir eine Vorschau auf verschiedene Kennzahlen.

SAP-Quartalszahlen: Erwartungen gerade so erfüllt, Ausblick bestätigt

Die SAP-Quartalszahlen zeigen: Die Erwartungen wurden ziemlich genau erfüllt, der Ausblick für 2024 wird bestätigt.

Alphabet-Quartalszahlen Donnerstag: Hoffnungen auf Dividende!

Die Google-Mutter Alphabet meldet Donnerstag Zahlen. Erstmals könnte man (wie zuletzt Meta) die Zahlung einer Dividende verkünden.

kryptowaehrungen

Hohe Volatilität vor dem Halving Bitcoin fällt vor dem Halving unter 60.000 USD – Nahost-Konflikt

Kurz vor dem bevorstehenden Bitcoin-Halving zog die Volatilität nochmal an, nachdem die Situation im Nahen Osten weiter eskaliert war. Der…

Marktkapitalisierung erreicht 55% Bitcoin-Dominanz am Kryptomarkt steigt wegen der Spot-ETFs

Die Einführung der Bitcoin Spot ETFs im Januar hat der bekanntesten Kryptowährung der Welt weiteren Auftrieb verliehen und den Kurs…

Eskalation im Nahen Osten Bitcoin-Absturz wegen Iran-Angriff – Ein Warnsignal für die Märkte

Der Bitcoin hat seine jüngste Talfahrt fortgesetzt und ist am späten Samstagabend auf 60.000 USD abgestürzt, nachdem der Iran einen…

Aussagen von Francois Villeroy de Galhau Zinsen senken im Juni – Öl-Unsicherheit kein Hindernis laut EZB-Entscheider

Laut einem wichtigen EZB-Ratsmitglied wird die Unsicherheit beim Ölpreis die Senkung der Zinsen im Juni nicht behindern.

"Seit Jahren besorgniserregender Abwärtstrend" Industrieproduktion soll in 2024 weiter sinken – BDI-Aussagen

Die Industrieproduktion ist seit sechs Jahren schon um 13 % rückläufig, und der Industrieverband BDI sieht für 2024 ein Minus von 1,5 %.

Markus Koch LIVE – Ist der Boden am Aktienmarkt gefunden?

Markus Koch meldet sich LIVE. Nach dem Absturz am Freitag ist die Frage, ob der Markt seinen Boden gefunden hat.