finanzmarktwelt – Ihr Auge im Zentrum der Finanzen

Super Micro Computer: Aktie crasht um 17 % – der Grund

Korrektur zum Einstieg nutzen? Aktienmärkte: Buying the Dip ist besser als Bargeld zu halten

Chartanalyse Indizes: Märkte hoffen auf den Abflug

Netflix-Aktie verliert 7 % trotz toller Zahlen – Erklärungsversuch

Asiatische Eliten und das Reich der Mitte China: Der gefürchtete Partner Asiens

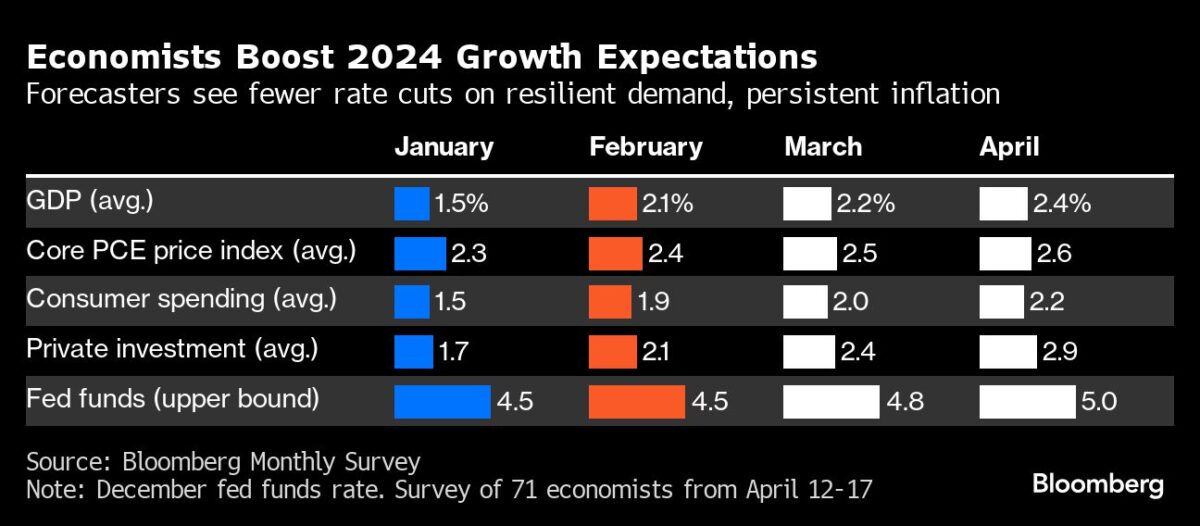

5 Tage in Folge fallende Kurse US-Aktien: Anleger ziehen Geld ab – Inflation und Zinsen

Inflation zu hoch, Konjunktur zu stark Fed-Powell stellt Uhr für Senkung der Zinsen zurück – Analyse

Tesla ruft Cybertrucks zurück – Deutsche Bank crasht Kursziel für Aktie

Meist gelesen 7 Tage

Neue Herausforderungen für Miner Bitcoin-Halving wird den Krypto-Minern einen Schlag verpassen

EZB senkt die Zinsen im Juni, Fed nicht – Abweichung birgt Risiken

Zeit für eine Gold-Korrektur? Warum der Goldpreis trotz der Eskalation im Nahen Osten fällt

Unsere Zinsen - euer Problem.. Powell-Aussagen zu Zinsen sind Problem für die „Rest-Welt“

Ausblick bis Jahresende Zinsen senken – Großbanken sehen nur noch 3 EZB-Schritte

Eskalation im Nahen Osten Bitcoin-Absturz wegen Iran-Angriff – Ein Warnsignal für die Märkte

Wiederholt sich der Nickel-Schock von 2022? Neue Russland-Sanktionen: Aluminium, Nickel steigen sprunghaft

Goldpreis soll auf 3.000 Dollar steigen laut Citi – aktuelle Aussagen

Rheinmetall-Aktie: KGV soll bis 2026 auf 15 sinken

indizes

Korrektur zum Einstieg nutzen? Aktienmärkte: Buying the Dip ist besser als Bargeld zu halten

Ist nach der jüngsten Korrektur an den Börsen der Zeitpunkte gekommen, um wieder bei Aktien zuzugreifen? Fragt man die Bank…

Aktienmärkte und Ölpreis glauben aktuell an begrenzten Angriff auf Iran

Wichtige Aussage von ARD-Expertin Natalie Amiri!

Index fällt kurzzeitig auf 17.400 Punkte Dax: Nächster Kurseinbruch nach Israel-Angriff auf den Iran

Der Dax zeigte sich auch am Donnerstag richtungslos. Zwar stabilisierte er sich nach dem jüngsten Kurseinbruch, allerdings müssen die Anleger…

Allgemein

5 Tage in Folge fallende Kurse US-Aktien: Anleger ziehen Geld ab – Inflation und Zinsen

Die Anleger ziehen ihr Geld aus Aktien ab, da die starke US-Wirtschaft und die hartnäckige Inflation die Befürchtung nähren, dass…

Inflation zu hoch, Konjunktur zu stark Fed-Powell stellt Uhr für Senkung der Zinsen zurück – Analyse

Immer mehr spricht für längere Zeit höhere Zinsen bei der Federal Reserve. Hier eine Analyse mit zahlreichen Aussagen aus dem…

Israel debattiert – war der Angriff auf den Iran ausreichend stark?

Nach dem Angriff auf den Iran läuft in Israel die Diskussion, ob der Angriff ausreichend stark war. Hier dazu einige…

Rohstoffe

Ölpreis fällt weiter – gefährliche Ignoranz vor Israel-Angriff?

Der Ölpreis rutscht weiter ab. Der Ölmarkt scheint die Gefahr des anstehenden Israel-Angriffs zu irgnorieren oder als harmlos anzusehen.

Aktuell: Öl-Lagerbestände +2,7 Mio Barrels (jetzt 460,0 Mio)

Die wöchentlich vermeldeten Öl-Lagerbestände in den USA (Rohöl) wurden soeben mit 460,0 Millionen Barrels veröffentlicht. Dies ist im Vergleich zur…

Israel vor Angriff gegen den Iran Ölpreis vor massivem Anstieg? Rekordumsatz bei Call-Optionen

Der Handel mit Call-Optionen auf den Ölpreis erreicht ein Rekordhoch, da der israelische Angriff auf den Iran bald starten könnte.

Indizes

Wie stark wird die lang erwartete Korrektur? S&P 500: Zins- und Inflationsdruck und ein Abverkauf bei Tech bringen das Schönwetter-Szenario ins Wanken

S&P 500 und Nasdaq wanken. Hier zeigen wir eine Analyse der Faktoren, die derzeit den US-Aktienmarkt belasten.

Korrektur zum Einstieg nutzen? Aktienmärkte: Buying the Dip ist besser als Bargeld zu halten

Ist nach der jüngsten Korrektur an den Börsen der Zeitpunkte gekommen, um wieder bei Aktien zuzugreifen? Fragt man die Bank…

Aktienmärkte und Ölpreis glauben aktuell an begrenzten Angriff auf Iran

Wichtige Aussage von ARD-Expertin Natalie Amiri!

Konjunkturdaten

Erzeugerpreise der Industrie jetzt neun Monate am Stück deflationär

Die Erzeugerpreise der deutschen Industrie sind jetzt neun Monate am Stück deflationär. Im März waren es im Jahresvergleich -2,9 %.

US-Renditen steigen Wirtschaft USA: Erstanträge ok, Philadelphia Fed Index stark – Preise höher

Neue Daten zur Lage der Wirtschaft in den USA: Die US-Erstanträge (jobless claims) auf Arbeitslosenhilfe (für die letzte Woche) –…

Aktuelle Lage der deutschen Wirtschaft weiter schwach ZEW Index besser: Viel Hoffnung, aber wenig Realität

Jeden Monat wird der ZEW-Index vom Mannheimer Zentrum für Europäische Wirtschaftsforschung erhoben – der Index gilt als ein wichtiger Frühindikator…

Aktien

Super Micro Computer: Aktie crasht um 17 % – der Grund

Super Micro Computer verkündet die Daten der Quartalszahlen, ohne Vorab-Finanzdaten. Das führt zum 17 % Crash.

Netflix-Aktie verliert 7 % trotz toller Zahlen – Erklärungsversuch

Die Netflix-Aktie verliert heute 7 % trotz toller Quartalszahlen gestern Abend. Hier dazu ein Erklärungsversuch.

Tesla ruft Cybertrucks zurück – Deutsche Bank crasht Kursziel für Aktie

Tesla ruft knapp 4.000 Cybertrucks zurück um Gaspedale zu reparieren oder auszutauschen. Dazu kommt eine massive Aktienabstufung.

kryptowaehrungen

Hohe Volatilität vor dem Halving Bitcoin fällt vor dem Halving unter 60.000 USD – Nahost-Konflikt

Kurz vor dem bevorstehenden Bitcoin-Halving zog die Volatilität nochmal an, nachdem die Situation im Nahen Osten weiter eskaliert war. Der…

Marktkapitalisierung erreicht 55% Bitcoin-Dominanz am Kryptomarkt steigt wegen der Spot-ETFs

Die Einführung der Bitcoin Spot ETFs im Januar hat der bekanntesten Kryptowährung der Welt weiteren Auftrieb verliehen und den Kurs…

Eskalation im Nahen Osten Bitcoin-Absturz wegen Iran-Angriff – Ein Warnsignal für die Märkte

Der Bitcoin hat seine jüngste Talfahrt fortgesetzt und ist am späten Samstagabend auf 60.000 USD abgestürzt, nachdem der Iran einen…

Tesla ruft Cybertrucks zurück – Deutsche Bank crasht Kursziel für Aktie

Tesla ruft knapp 4.000 Cybertrucks zurück um Gaspedale zu reparieren oder auszutauschen. Dazu kommt eine massive Aktienabstufung.

Israel debattiert – war der Angriff auf den Iran ausreichend stark?

Nach dem Angriff auf den Iran läuft in Israel die Diskussion, ob der Angriff ausreichend stark war. Hier dazu einige israelische Stimmen.

Ohne Subventionen geht nichts Crash bei Elektroauto-Absatz gefährdet die EU-Klimaziele

Der starke Einbruch des Elektroauto-Absatzes in Europa ist eine rote Fahne für die Klimaziele der Region. Die sinkenden Verkaufszahlen von Elektrofahrzeugen in Europa sind ein schmerzlicher Beweis dafür, dass der…