finanzmarktwelt – Ihr Auge im Zentrum der Finanzen

Chartanalyse Bären im Winner-Team? Indizes im Blick

Markus Koch LIVE – Netflix, Micron, AMD, Tesla

US-Renditen steigen Wirtschaft USA: Erstanträge ok, Philadelphia Fed Index stark – Preise höher

US-Anleiherendite kann wieder auf 5 % steigen – Top-Player warnt

Aber "Gegenwind aus verschiedenen Richtungen" Deutschland: Wirtschaft gewachsen und doch keine Rezession?

Netflix-Quartalszahlen heute Abend – die Vorschau

Börsen Jäger: EURUSD-Bären im Vorteil – Tradingidee

EU-Regierungschefs unter Zugzwang Europa: Ist der Niedergang nur mit mehr Schulden abzuwenden?

Meist gelesen 7 Tage

Neue Herausforderungen für Miner Bitcoin-Halving wird den Krypto-Minern einen Schlag verpassen

EZB senkt die Zinsen im Juni, Fed nicht – Abweichung birgt Risiken

Zeit für eine Gold-Korrektur? Warum der Goldpreis trotz der Eskalation im Nahen Osten fällt

Unsere Zinsen - euer Problem.. Powell-Aussagen zu Zinsen sind Problem für die „Rest-Welt“

Ausblick bis Jahresende Zinsen senken – Großbanken sehen nur noch 3 EZB-Schritte

Eskalation im Nahen Osten Bitcoin-Absturz wegen Iran-Angriff – Ein Warnsignal für die Märkte

Wiederholt sich der Nickel-Schock von 2022? Neue Russland-Sanktionen: Aluminium, Nickel steigen sprunghaft

Goldpreis soll auf 3.000 Dollar steigen laut Citi – aktuelle Aussagen

Rheinmetall-Aktie: KGV soll bis 2026 auf 15 sinken

finanznews

Aktienmärkte überverkauft – aber das Bullen-Narrativ geht baden! Videoausblick

Die Aktienmärkte sind nach dem Abverkauf der letzten Tage inzwischen (im kurzen Zeitfenster) überverkauft – aber dafür gibt es gute…

Unsere Zinsen, euer Problem! Stürzt die Fed die Welt in eine Rezession? Marktgeflüster (Video)

Früher (1970er-Jahre) hieß es: der Dollar ist unsere Währung, aber eurer Problem – heute gilt: es sind unsere Zinsen, aber…

Aktien: 2 schlechte Nachrichten – Zinsen und Zweifel an KI-Blase! Videoausblick

Aktien müssen heute zwei schlechte Nachrichten verarbeiten: erstens hat Fed-Chef Powell einer Senkung der Zinsen in absehbarer Zeit eine klare…

Allgemein

EU-Regierungschefs unter Zugzwang Europa: Ist der Niedergang nur mit mehr Schulden abzuwenden?

Die Europäische Union (EU) hat gegenüber ihren wichtigsten geopolitischen Rivalen an Schlagkraft verloren und in den europäischen Hauptstädten schrillen daher…

EZB senkt die Zinsen im Juni, Fed nicht – Abweichung birgt Risiken

Die Europäische Zentralbank (EZB) wird wohl erstmals vor der US-Notenbank Fed die Zinsen senken. Es gibt inzwischen eindeutige Anzeichen dafür,…

Unsere Zinsen - euer Problem.. Powell-Aussagen zu Zinsen sind Problem für die „Rest-Welt“

Der Vorsitzende der US-Notenbank Fed, Jerome Powell, macht seinen Kollegen auf der ganzen Welt das Leben schwer, da die Aussicht…

Rohstoffe

Ölpreis fällt weiter – gefährliche Ignoranz vor Israel-Angriff?

Der Ölpreis rutscht weiter ab. Der Ölmarkt scheint die Gefahr des anstehenden Israel-Angriffs zu irgnorieren oder als harmlos anzusehen.

Aktuell: Öl-Lagerbestände +2,7 Mio Barrels (jetzt 460,0 Mio)

Die wöchentlich vermeldeten Öl-Lagerbestände in den USA (Rohöl) wurden soeben mit 460,0 Millionen Barrels veröffentlicht. Dies ist im Vergleich zur…

Israel vor Angriff gegen den Iran Ölpreis vor massivem Anstieg? Rekordumsatz bei Call-Optionen

Der Handel mit Call-Optionen auf den Ölpreis erreicht ein Rekordhoch, da der israelische Angriff auf den Iran bald starten könnte.

Indizes

Experte hat Dax-Short geschlossen – hier die Erläuterung

Der Börsenexperte Andre Stagge hatte Ende letzter Woche den Dax geshortet und die Position jetzt im Gewinn geschlossen. Er erläutert…

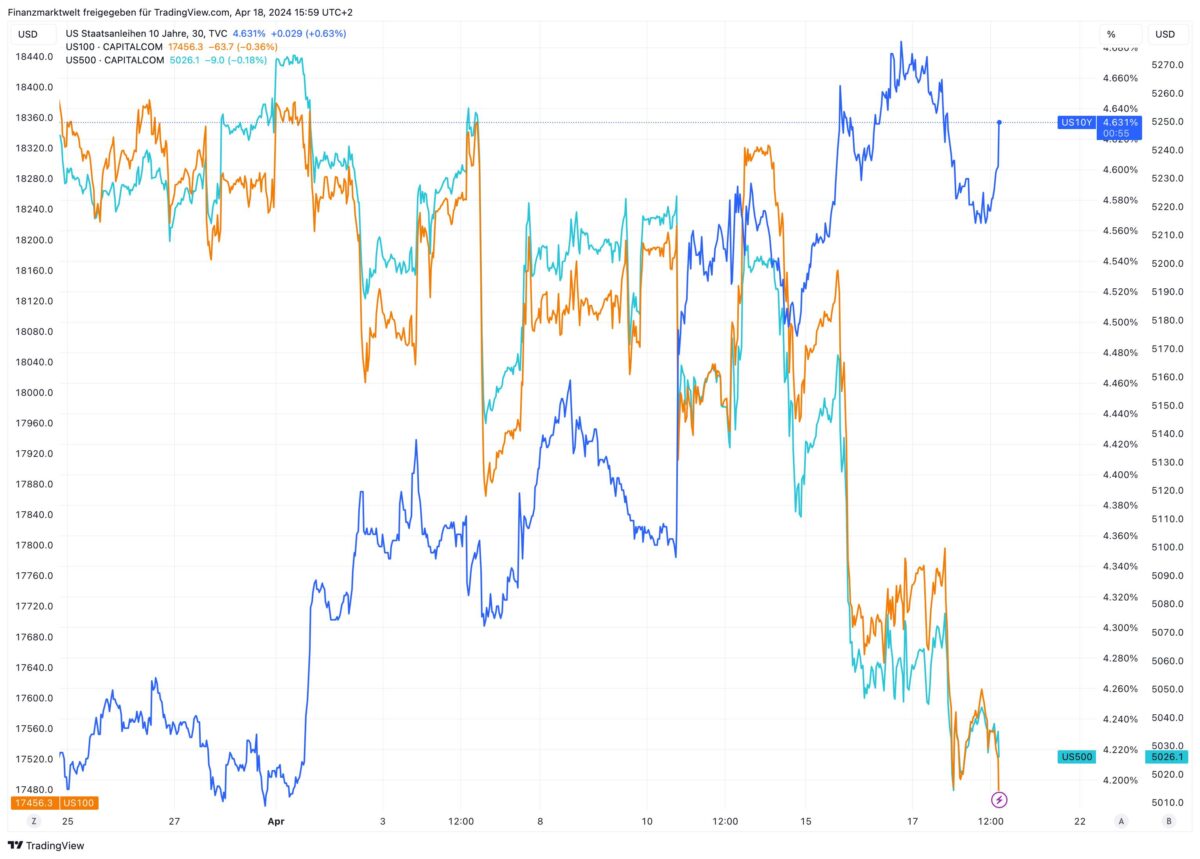

US-Aktienmärkte unter Druck durch steigende US-Anleiherenditen

Die US-Aktienmärkte stehen derzeit unter Druck. Der Nasdaq verliert seit Wochenanfang gut 650 Punkte, der S&P 500 gut 150 Punkte.…

Richtungsentscheidung steht an Dax-Erholung stockt: Geopolitisches Risiko im Nahen Osten bremst

Der Dax hat zur Wochenmitte einen zaghaften Erholungsversuch eingeleitet, nachdem die Anleger zuletzt etwas Luft aus dem überhitzten Leitindex herausgelassen…

Konjunkturdaten

US-Renditen steigen Wirtschaft USA: Erstanträge ok, Philadelphia Fed Index stark – Preise höher

Neue Daten zur Lage der Wirtschaft in den USA: Die US-Erstanträge (jobless claims) auf Arbeitslosenhilfe (für die letzte Woche) –…

Aktuelle Lage der deutschen Wirtschaft weiter schwach ZEW Index besser: Viel Hoffnung, aber wenig Realität

Jeden Monat wird der ZEW-Index vom Mannheimer Zentrum für Europäische Wirtschaftsforschung erhoben – der Index gilt als ein wichtiger Frühindikator…

US-Renditen und Dollar steigen deutlich USA: Einzelhandelsumsatz besser, New York Empire schwächer

Soeben die US-Einzelhandelsumsätze für den Monat März veröffentlicht: Sie sind im Monatsvergleich mit +0,7 Prozent besser als erwartet ausgefallen (Prognose…

Aktien

Markus Koch LIVE – Netflix, Micron, AMD, Tesla

Markus Koch meldet sich LIVE vor dem Handelsstart in New York. Besprochen werden unter anderem die Aktien von Netflix, Micron,…

Netflix-Quartalszahlen heute Abend – die Vorschau

Netflix meldet heute Abend seine Quartalszahlen kurz nach 22 Uhr deutscher Zeit. Wir werden dann umgehend berichten. Hier bieten wir…

Höhere Umsatzerwartung für aktuelles Quartal TSMC übertrifft aktuell mit seinen Quartalszahlen die Erwartungen

Die Taiwan Semiconductor Manufacturing Co (TSMC) hat vor wenigen Minuten ihre Quartalszahlen veröffentlicht. Das Unternehmen verzeichnete den ersten Gewinnanstieg seit…

kryptowaehrungen

Marktkapitalisierung erreicht 55% Bitcoin-Dominanz am Kryptomarkt steigt wegen der Spot-ETFs

Die Einführung der Bitcoin Spot ETFs im Januar hat der bekanntesten Kryptowährung der Welt weiteren Auftrieb verliehen und den Kurs…

Eskalation im Nahen Osten Bitcoin-Absturz wegen Iran-Angriff – Ein Warnsignal für die Märkte

Der Bitcoin hat seine jüngste Talfahrt fortgesetzt und ist am späten Samstagabend auf 60.000 USD abgestürzt, nachdem der Iran einen…

Schlechteste Woche in 2024 Bitcoin-Korrektur: Der Abverkauf ist laut Experten nicht zu Ende

Der Bitcoin-Kurs erlebte eine scharfe Korrektur nach dem Erreichen eines neuen Rekordhochs. Ein Grund für den jüngsten Abverkauf findet sich…

EU-Regierungschefs unter Zugzwang Europa: Ist der Niedergang nur mit mehr Schulden abzuwenden?

Die Europäische Union (EU) hat gegenüber ihren wichtigsten geopolitischen Rivalen an Schlagkraft verloren und in den europäischen Hauptstädten schrillen daher die Alarmglocken. Die Staats- und Regierungschefs müssen jetzt überlegen, wie…

Ölpreis fällt weiter – gefährliche Ignoranz vor Israel-Angriff?

Der Ölpreis rutscht weiter ab. Der Ölmarkt scheint die Gefahr des anstehenden Israel-Angriffs zu irgnorieren oder als harmlos anzusehen.

Aktienmärkte überverkauft – aber das Bullen-Narrativ geht baden! Videoausblick

Die Aktienmärkte sind nach dem Abverkauf der letzten Tage inzwischen (im kurzen Zeitfenster) überverkauft – aber dafür gibt es gute Gründe: das Goldilocks-Narrativ der Bullen ist ziemlich kaputt geschossen! Denn…