finanzmarktwelt – Ihr Auge im Zentrum der Finanzen

KI: Viel Hype - wenig Ertrag Abverkauf der Meta-Aktie: KI kostet viel und bringt wenig ein

BASF-Quartalszahlen: Umsatz sinkt deutlich, Gewinn leicht über Erwartung

Deutsche Bank-Quartalszahlen: Steigerung, aber unter Erwartung

Berichtssaison als Impulsgeber Dax: Eine Flut an Quartalszahlen bestimmt die Richtung

Meta-Quartalszahlen: Daten besser, aber Aussichten schlechter – Aktie -12 %

Trotz Tesla-Euphorie: Aktien-Rally verpufft – warum? Marktgeflüster (Video)

Chartanalyse Indizes: Ist der Schalter auf Kaufen umgelegt?

Ist die Energiekrise in Europa vorbei? – Gashändler bezweifeln das

Meist gelesen 7 Tage

Ölpreis und Fed-Politik bergen Risiken EZB senkt die Zinsen im Juni, aber was kommt danach?

Aussagen von EZB-Vizepräsident EZB senkt Zinsen im Juni – beschlossene Sache, wenn…

Bitcoin-Halving ist abgeschlossen – die aktuelle Lage

Die ungebrochene Nachfrage Chinas Gold: China steht im Mittelpunkt der rekordverdächtigen Rally

Größter Tageseinbruch seit fast 2 Jahren Goldpreis stürzt ab: Händler preisen die Kriegsrisiko-Prämie aus

Super Micro Computer: Aktie crasht um 17 % – der Grund

Fokus wieder auf Fed-Politik Goldpreis fällt, da die Spannungen im Nahen Osten nachlassen

Nasdaq: KI-Blase platzt weiter – und Verfalls-Erscheinungen! Marktgeflüster (Video)

Ohne Subventionen geht nichts Crash bei Elektroauto-Absatz gefährdet die EU-Klimaziele

allgemein

Russland: Nornickel will in China produzieren und Sanktionen umschiffen

Ein wichtiger Produzent will seine Kupferverhüttung in Russland wegen westlichen Sanktionen nach China verlagern.

Heute Daten-Meldung 14:30 Uhr US-Bruttoinlandsprodukt wird Boom durch Einwanderung zeigen

Das US-Bruttoinlandsprodukt wird heute um 14:30 Uhr vermeldet. Es soll weiterhin gut wachsen. Einwanderung dürfte eine Rolle spielen!

Abstieg einer Metropole Bedeutungsverlust: Hongkong verlässt Top 10 der wichtigsten Häfen

Die Bedeutung von Hongkong hat sich in den letzten Jahren stark verändert. Seit der Einführung des Nationalen Sicherheitsgesetzes und des…

Allgemein

Abstieg einer Metropole Bedeutungsverlust: Hongkong verlässt Top 10 der wichtigsten Häfen

Die Bedeutung von Hongkong hat sich in den letzten Jahren stark verändert. Seit der Einführung des Nationalen Sicherheitsgesetzes und des…

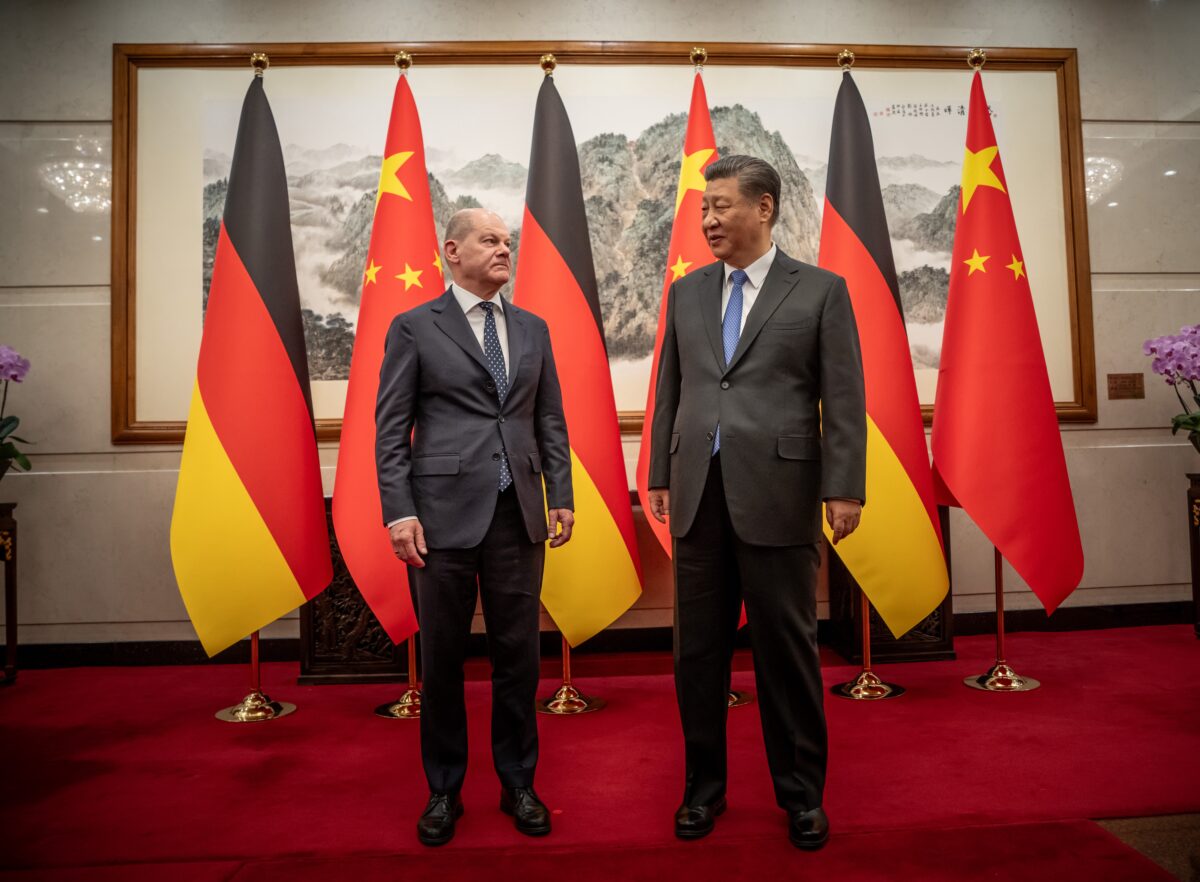

Statt Großaufträgen Vereinbarungen über Äpfel.. Scholz in China: Äpfel statt Autos

Von der einstigen Wirtschaftsmacht zum symbolischen Warenkorb

Industrie schwach, Dienstleister gut ifo Index besser – Hoffnung auf sinkende Zinsen

Der ifo Index (ifo-Geschäftsklimaindex) für April wurde soeben veröffentlicht: er steigt auf 89,4 Punkte (Prognose war 88,9) nach 87,9 Punkten…

Rohstoffe

Ist die Energiekrise in Europa vorbei? – Gashändler bezweifeln das

Nach mehr als einem Jahr Pause von den Rekordpreisschwankungen auf dem europäischen Erdgasmarkt werden die Gashändler wieder unruhig. Wie ein…

Aktuell: Öl-Lagerbestände -6,4 Mio Barrels (jetzt 453,6 Mio)

Die wöchentlich vermeldeten Öl-Lagerbestände in den USA (Rohöl) wurden soeben mit 453,6 Millionen Barrels veröffentlicht. Dies ist im Vergleich zur…

Ölpreis soll fallen? BILD-Titel – bitte nicht zu früh freuen!

Laut BILD sollen die Preise an der Tankstelle fallen, es gebe einen "Scheich-Plan". Fällt der Ölpreis wirklich? Schauen wir uns…

Indizes

Berichtssaison als Impulsgeber Dax: Eine Flut an Quartalszahlen bestimmt die Richtung

Der Dax hat am Mittwoch seine frühen Gewinne abgegeben, nachdem sich die Situation im Nahen Osten wieder zugespitzt hat. Anfangs…

Chartanalyse Indizes: Ist der Schalter auf Kaufen umgelegt?

Sehen wir im Dax gerade eine „schöne“ Korrektivbewegung, und danach geht es weiter aufwärts? Hier dazu meine aktuelle Analyse. Watch…

Big Tech-Zahlen und Inflationsdaten US-Börsen vor Tagen der Wahrheit – Worauf es jetzt ankommt

Im Vorfeld wichtiger Quartalszahlen der Tech-Giganten und frischer Inflationsdaten haben die US-Börsen am Dienstag ihre Vortagsgewinne ausgebaut. Zum Handelsschluss lagen…

Konjunkturdaten

Inflation wechselt in Güter-Sektor, Stellenabbau Wirtschaft USA: Einkaufsmanagerindex schwach – „Nachfrage-Schwäche“

Stagflation voraus!

Starke Inflation bei Dienstleistern wegen Löhnen Deutschland: Industrie in tiefer Rezession, Dienstleister stark

Die Industrie ist in Deutschland weiter im Sinfklug, die Dienstleister aber sind robust – das zeigt der Einkaufsmanagerindex für die…

Erzeugerpreise der Industrie jetzt neun Monate am Stück deflationär

Die Erzeugerpreise der deutschen Industrie sind jetzt neun Monate am Stück deflationär. Im März waren es im Jahresvergleich -2,9 %.

Aktien

BHP will Anglo American kaufen – der Mega-Rohstoff-Deal

Der Mega-Rohstoffkonzern BHP will den Konkurrenten Anglo American übernehmen. Hier die Details und die Schwierigkeiten.

KI: Viel Hype - wenig Ertrag Abverkauf der Meta-Aktie: KI kostet viel und bringt wenig ein

Der Chef der Facebook-Mutter Meta Platforms, Mark Zuckerberg, bittet die Investoren um Geduld. Wieder einmal. Grund sind nicht die am…

BASF-Quartalszahlen: Umsatz sinkt deutlich, Gewinn leicht über Erwartung

Die BASF-Quartalszahlen zeigen deutlich sinkende Umsätze, aber dafür einen Gewinn, der leicht über den Erwartungen liegt.

kryptowaehrungen

Hohe Volatilität vor dem Halving Bitcoin fällt vor dem Halving unter 60.000 USD – Nahost-Konflikt

Kurz vor dem bevorstehenden Bitcoin-Halving zog die Volatilität nochmal an, nachdem die Situation im Nahen Osten weiter eskaliert war. Der…

Marktkapitalisierung erreicht 55% Bitcoin-Dominanz am Kryptomarkt steigt wegen der Spot-ETFs

Die Einführung der Bitcoin Spot ETFs im Januar hat der bekanntesten Kryptowährung der Welt weiteren Auftrieb verliehen und den Kurs…

Eskalation im Nahen Osten Bitcoin-Absturz wegen Iran-Angriff – Ein Warnsignal für die Märkte

Der Bitcoin hat seine jüngste Talfahrt fortgesetzt und ist am späten Samstagabend auf 60.000 USD abgestürzt, nachdem der Iran einen…

Ist die Energiekrise in Europa vorbei? – Gashändler bezweifeln das

Nach mehr als einem Jahr Pause von den Rekordpreisschwankungen auf dem europäischen Erdgasmarkt werden die Gashändler wieder unruhig. Wie ein Bericht von Bloomberg zeigt, sorgen sich die Gashändler in Europa…

Aktuell: Öl-Lagerbestände -6,4 Mio Barrels (jetzt 453,6 Mio)

Die wöchentlich vermeldeten Öl-Lagerbestände in den USA (Rohöl) wurden soeben mit 453,6 Millionen Barrels veröffentlicht. Dies ist im Vergleich zur Vorwoche ein Minus von 6,4 Millionen Barrels, wobei die Erwartungen…

Abstieg einer Metropole Bedeutungsverlust: Hongkong verlässt Top 10 der wichtigsten Häfen

Die Bedeutung von Hongkong hat sich in den letzten Jahren stark verändert. Seit der Einführung des Nationalen Sicherheitsgesetzes und des „Artikel 23“ verlassen immer mehr internationale Unternehmen die Stadt. Hongkong,…